Ship Recycling Market Exits “Crisis Mode”, Outlook Now More Positive

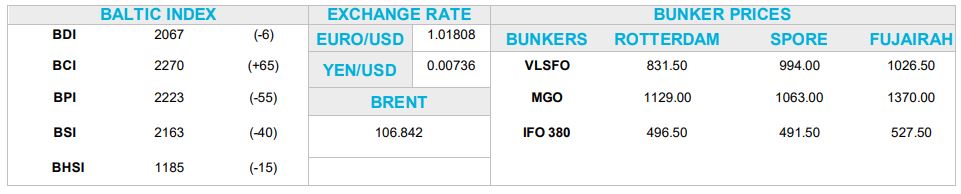

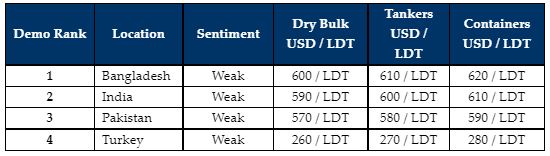

The ship recycling market has had to endure some pretty turbulent weeks, but things are starting to pick up once more. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “in what has been a gloomy couple of weeks for the market, coupled with a lack of tonnage and price levels alarmingly coming off, there is now a more positive outlook in the past few days with steel prices rallying by nearly 15% locally. This has prompted end recyclers to put forward more prominent enquiries and cash buyers quoting back closer to the USD 600 $/per ldt number once again for market tonnage. It is worth noting that we are still in a precarious position due to the local currencies against the US dollar across all the Indian sub-continent areas and this could affect the market at any time, with VLCCs being quoted 30/40 dollars below other smaller units due to the large outlay and lack of financing available to fund such large LDT units”.

The shipbroker added that “Bangladesh once again feels the firmest market with mixed signals coming from Pakistan as to how aggressive they are for tonnage, especially as cash buyers still feel wounded from the recent round of re-negotiations, they encountered from the waterfront in Gadani and may feel hesitant to engage with the local end buyers. Pricing is very difficult to assess however as the market needs a definitive sale so that we can start to accurately guide where pricing truly lies, but with the firming freight markets in the Tanker sector over the past few weeks, it will be some time before we start to see a glut of tonnage for recyclers to feast upon”.

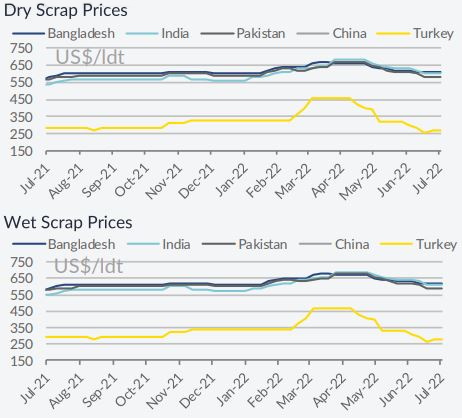

In a separate note, Allied Shipbroking said this week that “with a fair number of transactions taking place under the current unfavourable conditions in the ship recycling market, the market’s performance recorded an improvement driven by the slight rises and stabilization that took place in steel prices in the Indian SubContinent. Nevertheless, market sentiment and forward outlooks remain discouraging as the effects of difficult weather conditions in the midst of the Monsoon Season, combined with weakening local currencies, continue to have a negative overall impact on the already sluggish Bangladeshi and Indian markets. Pakistan has made a very small improvement in terms of offered scrap price levels but has not been enough to secure any significant volume of tonnage. However, with regard to Bangladesh, we will probably have a clearer overview of the market’s true potential once the Eid Celebrations are over. In Turkey, in addition to the continued rising inflation rate noted, the government imposed taxes on steel imports from companies in Europe and South Korea wanting to boost domestic production which in turn could help boost confidence amongst ship recyclers to bolster their offered prices”.

Similarly, GMS, the world’s leading cash buyer of ships said that “as we enter the traditionally quieter monsoon season, it is of little surprise to see recycling markets remaining inert and quiet, with rains/flooding hampering production at yards in Chattogram and Alang labourers returning to their hometowns as recycling activities come to a seasonal crawl. This may have inadvertently triggered the recent levelling of sub-continent steel plate prices as steel output diminishes and plate prices stabilize / firm in reaction. Although vessel prices have cooled off by USD 100/LDT in the sub-continent markets and about USD 250/MT in Turkey, global recycling sentiments remain in the doldrums given the rate of the recent declines. As such, there is no surprise to see minimal activity emanating from all markets at present, including the respective waterfronts that are displaying the shoddy state of current affairs.

Notwithstanding, global currency depreciation remains the primary source of heartburn for the ship-recycling communities, as the worrying declines on steel prices seem to have comparatively stabilized and we hope it should start to show some signs of positivity in the coming week(s). Whilst there still remains a degree of caution and a prevailing nervousness to buy in local markets, there are unlikely to be firm/serious offers for Owners and Cash Buyers alike, and this is part of the reason why even the marginal few candidates have started to dry up of late. Of course, all freight sectors continue to be positively poised as most Owners are now passing drydock on their aging beauties, rather than scrapping their older tonnage even when recycling rates are at historically firm numbers”, GMS concluded.

Source: Hellenic shipping news